Reading §

Chapter 5 §

- Small business

- Describe the characteristics of a small business (by Industry Canada).

- Independently owned,

employees < 100, revenues < $2 million

- In what industries do small business play a significant role?

- Provide jobs in construction, agriculture, wholesale trade, services, retail trade

- Discuss the contributions of small business to the economy

- What are the 3 key ways small business contribute?

- Provide new jobs, create new industries, innovate new ideas

- How are new industries formed

- When small business shift focus to meet consumer interest’s and preferences

- When both business and consumers see a need for change

- Discuss why small business fail ^428ef2

- What are some percentages for small business survival rate

- 96% in business for 1 year (4% close after 1 year)

- 85% in business for 2 year (15% close after 2 year)

- 70% in business for 5 year (30% fail within 5 years)

- What are the 3 main cause of small-business failure

- Management inexperience

- Inadequate financing

- Difficulty meeting government regulations

- Describe the features of an effective business plan

- What are the 5 main sections of a business plan?

- Executive summary

- Introduction

- Financial section

- Marketing section

- Resumes for the principals

- Importance for business plan. ^a9f6d6

- Writes out all the reasons a business can be successful (vision of founders & why the company is unique)

- Document needed to obtain financing

- Creates a framework for the organization

- Identify the assistance available for small business

- What are the various ways the BDC (Business Development Bank of Canada) helps small business.

- Provides long-term financial assistance and management counselling

- Provides information, advice, training to owners

- What are business incubators?

- Programs community agencies set up to help small business (low-cost rental space, shared clerical staff, shared office equipment)

- Why are small business good opportunism for women?

- Helps with family and work balance

- Explain franchising

- Differentiate franchisor with franchisee

- Franchisor: permits a small-business owner (franchisee) to market and sell the franchisor’s product under its brand name in return for a fee

- How does franchising benefit both parties

- Franchisor: opportunities for expansion & greater profits

- Franchise: name recognition, quick startup, support for the franchisor, freedom of small-business ownership

- Outline the forms of private business ownership

- What are the 3 legal forms of business ownership

- Sole proprietorship

- Owned and operated by one person

Pros: easy to set up and offer great operating flexibilityCons: personally liable for all firm’s debts and legal responsibilities

- Partnership

- Two or more individuals share responsibility for owning and running

Pros: easy to set upCons: do not protect either partner from liability

- Corporations ^8d7dbe

- Separate legal entity from its owners; investors receive shares from stock in the firm

Pros: owners have no legal and financial liability beyond individual investmentsCons: hard to set up

- What is the main characteristic of a not-for-profit corporation?

- Goal does not include pursuing a profit

- separate legal provisions

- Exempt from paying income taxes

- Describe public and collective business ownership

- Public ownership: a unit or agency owns and operates an organization

- Collective ownership: owners work together to operate all or part of the activities in their firm

- Allows small firms to pool resources, share equipment, experitise, and help each other

- Discuss the organizational structure of corporations

- What are the 2 key elements of the incorporation process (成立过程)?

- Where to incorporate

- The corporate charter (公司章程)

- Identify the 5 main levels of corporate ownership and management

- Shareholders

- Board of directors

- Top management (CEO, CFO…)

- Middle management

- supervisory management

- Describe mergers (并购), acquisitions (收购), and joint ventures (合资企业).

- Merger: >2 firms combine to form one company

Vertical merger: combines firms operating at different levels in production and marketing process

- Horizontal merger: joins firms int he same industry

- Conglomerate merger: combines unrelated firms

- Acquisitions: firms purchase another

- The buyer acquires the firm’s property & assets AND debt

- Joint venture: partnership between companies for a specific activity

Chapter 6 §

- Describe what is an entrepreneur and its different types.

- Explain why people choose to became entrepreneurs ^74557a

- What are the 4 main reasons people choose to become entrepreneurs?

- Be their own boos

- Greater financial success

- More control over job security

- Enhance quality of life

- What factors affect the entrepreneur’s job security?

- Depends on decisions of customers and investors

- Depends on cooperation nd commitment of their employees

- Discuss factors support and expand opportunities for entrepreneurs.

- Factors

- Favourable public perception

- Availability of financing

- Falling cost

- Widespread availability of technology

- Globalization

- Entrepreneurship education

- Changing demographic and economic trends

- Describe difference with entrepreneurs in different countries, new opportunities with globalization

- >9% starting or managing new business

- Globalization allows marketing aboard, hire international talent

- Many Canadian companies have international sales (especially with US)

- Identity educational factors that can help expand opportunities.

- Entrepreneurship majors

- Entrepreneurship emphasis (创业重点)

- Courses to start business

- Teaching in entrepreneurship by organizations

- Identity the traits of successful entrepreneurs ^3e009c

- Define entrepreneurs vision

- Overall idea for how to make their business idea a success

- Importance for high energy level and strong need for achievement

- Energy level: entrepreneurs need to work long hours (small staff number)

- Need for achievement: helps them enjoy challenge for reaching difficult goals

- Summarize the process of starting a new venture (风险投资)

- Process

- Choose idea

--> business plan --> obtain financing --> organize resources

- What are the 2 most important considerations for choosing an idea?

- Something one love/good at

- Meets the need in marketplace

- Differentiate debit financing & equity financing ^b6f84a

- Debt financing: money borrowed that must be repaid

- Equity financing: exchange of ownership shares for money

- Explain intrapreneurship (内部创业)

- Why do large companies support intrapreneurship?

- Keep entrepreneurs spirit alive to promote innovation and change

- What is a skunkworks

- A skunkworks project initiated by an employee who has an idea and then recruits resources from within the compnay to turn the idea into a commercial product

Lecture §

PDF:

- “Business and society”

- Wealth creation

- What is wealth and what is a wealth creation

- Wealth: the annual produce of the land and labour of society (Adam Smith)

- Wealth creation

- What is the Diamond of Sustainable Growth, and its four factors?

- What is required to create wealth

- Interdependence of business

- The diamond

- How is wealth created

- Product/service with

sell > cost

- Trade to get pay for what you have and sell you what you want

-

Case study: house sells §

```ad-case

- Buy a house, renovate it , sell it with a higher price

- Print, stage, add asset, clean up the house

```

- Forms of business ownership

- What are the 4 forms of private business ownership

- Proprietorship

- People and business combined together (personal level)

- LLP (limited liability partnership)

- Sole proprietorship

- Partner proprietorship

Prons: bring different things onto the table, risk is reduced, ★ partnership agreement (written)

- Cooperation

- Not-for-profit cooperation?

Pros and Cons for operation as a corporation

Pros

- Limited liability

- Business are separate from personal losses

- Taxes are separate from personal filings

- Easier to change ownership

- Perpetual life (business don’t die with owner)

- Easier to attract employee

Cons

- Double taxation (corporate tax, personal tax)

- Compliance to meet regulatory rules

- Higher startup cost, more paper work

- Less flexible

- What is the basic structure for corporate management

- Shareholders

- What is the difference between preferred share and common share

- Preferred stock gives no voting rights to shareholders while common stock does

- Can be co-owned

- Preferred shares

- “More secure”, limited to dividend

- ★ What are some characteristics of preferred shareholders (exceptions, not by default)

- Convertible (common share can be change to preferred share with a certain ratio)

- Redeemable (refundable)

- Participating (share the leftovers of dividend)

- Cumulative (dividend are cumulative, no interest)

- Dividend does has to be pay every year

- Dividend: leftover cash/income in company

- Callable (company choose to refund)

- Common shares

- “Real owners” earned the most, lose the most, not limited devident

- Board of directors

- Elected by the common shareholder

- Corporate offices & managers

- Selected by board of directors

- What are some characteristic of franchising

- Franchising agreements exist between franchisee and franchisor

- Canada has 76,000 individual franchise businesses operating under 900 different brand names

- These franchises employ more than one million Canadians

- More than $100 billion in sales each year

- Franchising overseas is a growing

- Franchisees does not compete with each other

- ★

Pros and Cons for franchising

Pros:

- Existing supply chain

- Existing business plan

- Lower risk

- Existing name recognition

- Easier to hire

- Can be easily adjusted for local market

- Prior performance record

- Tested management program

- Savings through volume purchases

Cons:

- Franchisee loss some control due to demand of franchisor (regulation limitation)

- Connected regulation (negative branding)

- High investment

- Pay Future payments (royalties)

- Has to be set up as a franchise

- Starting a business

- Why to make BP

- Help contemporary entrepreneurs prepare enough resources and stay focused on key objectives

- What are 3 financing strategy for starting business

- Seed capital: initial funding needed to launch a new vendor

- ★ Debit & Equity financing

- Debt: borrow money, has to be repaid (legal obligation)

- Credit cards

- Family and friends

- Bank loans

- Finance companies

- Interest (tax deductible)

- Higher risk involved (bankrupt)

- Equity: sell ownership, don’t has to be repaid

- Venture capitalists

- Angel investors

- Dividend (not tax deductible)

- Why small business fail (3+1 major reasons).

- Lack of business plan

- Example for business regulation

- Entrepreneurship

- Characteristics of entrepreneurs

- Having a vision

- High energy level

- Need achieve

- Optimism

- Tolerance for failure

- Creativity

- Tolerance for ambiguity

- Internal locus of control

- 4 reasons people choose to become entrepreneurs

- What are some challenges for entrepreneurs

- Highest risk/ highest return activity in business

- Great difficulties in raising investment funds for a brazen, new idea

- Reality is nearly always very different from what was planned

- High failure rate - even after initial funding secured

- Small business vs. entrepreneurial businesses

- Size

- Small b. remains small; entrepreneurial b. start small, expect to grow big

- Age

- Small b. remains stable, entrepreneurial b. grow up

- Growth goals

- Small b. not expected to grow

- Growth is priority for entrepreneurial b.

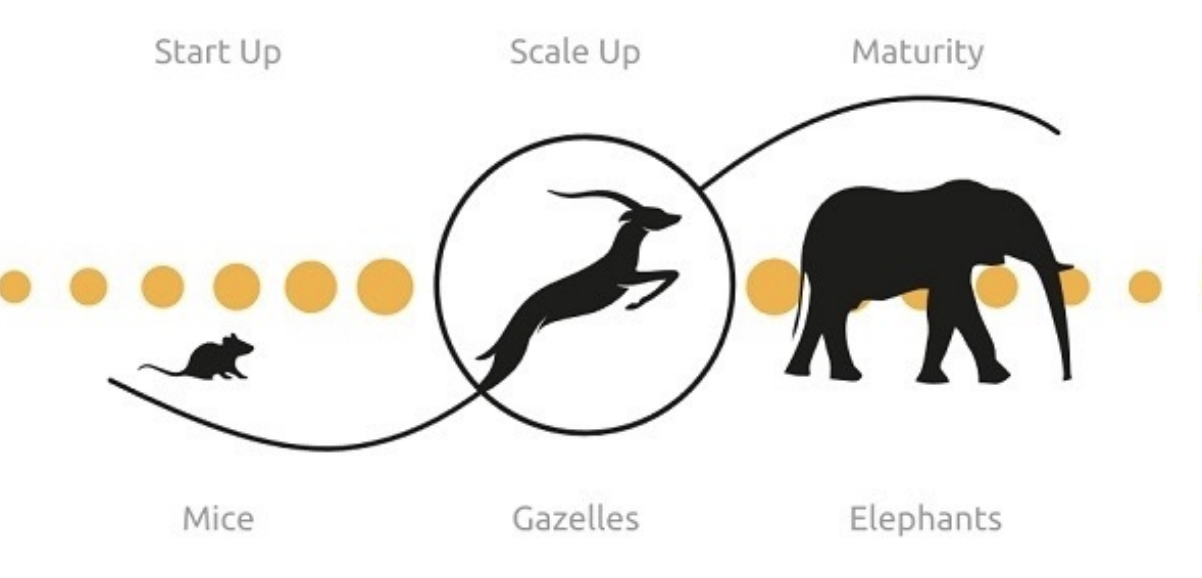

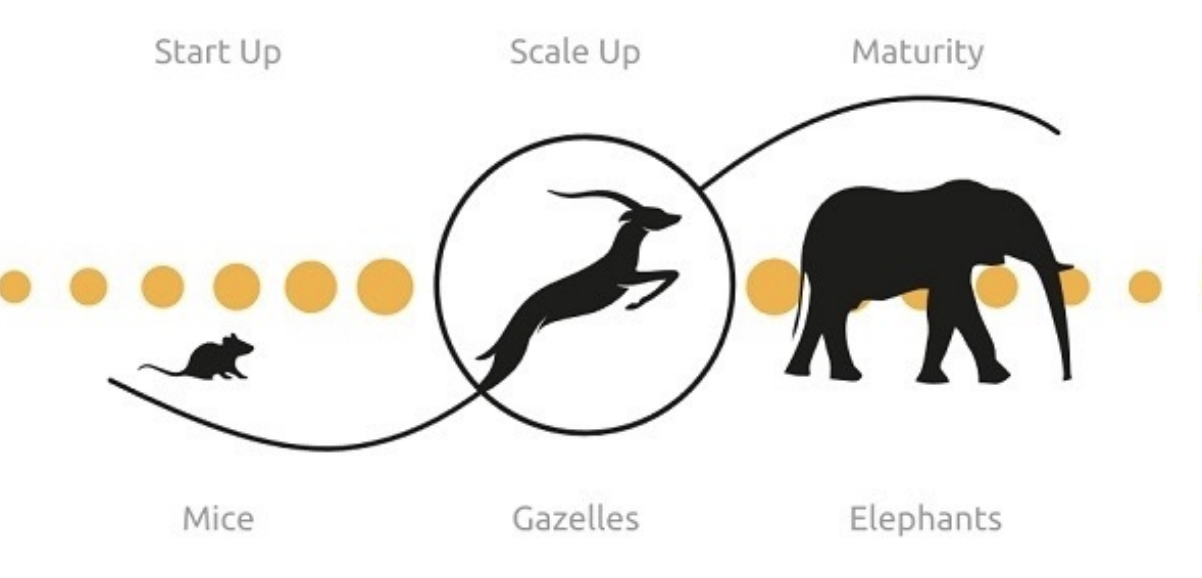

- David Birch Model

-

- Mice

Pros: can typically change direction quicklyCons: not powerful- Many do not aspire to grow large, so long as they remain attractively profitable

- Gazelles

Pros: can change directions quicklyCons: more powerful- A firm that seeks rapid growth AND above average profitability (>20% a year for 4 years, doubling in size)

- Often includes a radical business innovation/ implementation of new technology

- Elephants

Pros: very powerful, dominate in marketCons: cannot change directions quickly- “Fortune 500”

- Considerable overall marketplace power

- Difficult for them to change direction quickly

- Collectively, they have fired more people than they have hired in the past 25 year

-

Creating wealth during a pandemic (case study) §

```ad-case

Q: Is it a good to invest in Cheesecake Factory in COVID-19 **today**?

- Given statistic

- Revenue from 2020 droped

- Revenue from 2021 raised back backup

- Profit when to negative in 2020

- Profit recovered back to positive in 2021 (not stable even before covid)

- Stock prices droped in 2020, raised until 2023, droped throughout 2022

- Analysis

- Debate

- Revange travel (already done in 2022, still remaining in 2023)?

- Partner with delivery (?)

- Reasons for a good time:

- Expanded operations in 2021

- Already spent money, ready to collect profit

- Pandanmic killed competition, if demand come back, this would benefit their sells with fewer competition

- Reasons for not a good time:

- Possibility of entering another recession

- Lossed money during 2021, are they able to recover?

- Malls are closed (down), negative effect for the factory

- Competitors have already fired backrupt

- Fined by ... for not misleading investors

- Not able to pay rent for a period of time

- New trend for moving to healier diet

```

Active Studying §

Summarize today’s lecture §

- [::Most important/focused topic] Cooperation, Entrepreneur

- [::Most difficult part, why, how to resolve] Class participation

- Come with question prepared, raise hand quickly, follow with lecture quickly, raise hand with confidence

What part I didn’t understand, next step actions? §